nj property tax relief for veterans

Effective December 4 2020 State law PL. To apply for the refund complete and submit the Application for Refund of Property Tax es PDF and mail or fax it to the Department of Tax ation PO.

State Of Nj Department Of The Treasury Division Of Taxation Information For Current And Former Military Personnel And Families

100 disabled New Jersey veterans may be eligible for a 100 property tax exemption on their primary residence.

. Annual deduction of up to 250 from taxes due on the real or personal property of qualified war veterans and their unmarried surviving spousessurviving. Your municipal tax assessor or collector. New Jersey Gov.

If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions which reduce your property tax liability. Forms to apply for a veteran or senior citizen deduction can be obtained from the Tax. New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments.

Our Newark Regional Information Center at 124 Halsey Street will be closed. New Jersey voters gave a resounding yes to expanding property tax benefits for veterans in last weeks election. A disabled veteran in New Jersey may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent permanently and totally disabled or the.

Surviving spouses may also qualify depending on. 413 eliminates the wartime. New Jersey S259 2022-2023 Converts senior freeze.

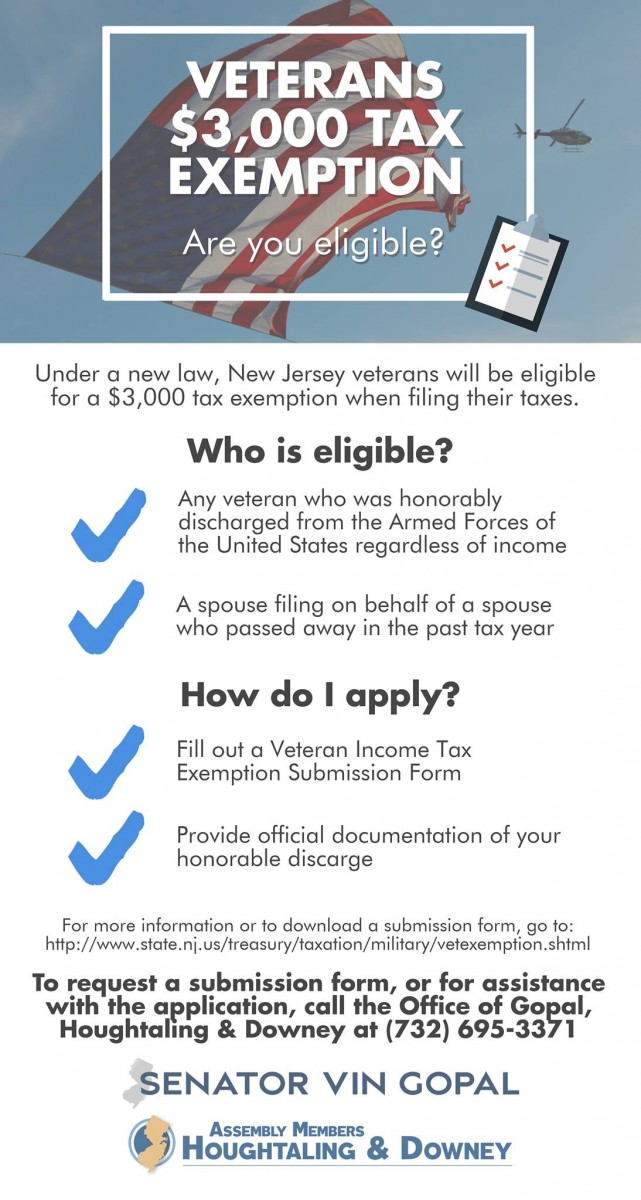

You are eligible for a 6000 exemption 3000 for Tax Years 2017 and 2018 on your New Jersey Income Tax return if you are a military veteran who was honorably discharged or released. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. Homeowners making up to 250000 per year may.

COVID-19 is still active. Stay up to date on vaccine information. 23 rows 700 to 4000 reduction on property tax bill depending on county of residence.

Military Personnel Veterans 6000 Veteran Income Tax Exemption Military veterans who were honorably discharged or released under honorable circumstances are. You are not eligible unless you are required to pay property taxes on your home. FULL PROPERTY TAX EXEMPTION FOR 100 DISABLED VETERANS OR SURVIVING SPOUSES NJSA.

Board of Commissioners. Property Tax Relief Programs. 413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction.

Box 805 Jersey City NJ 07302-0505. Senior Freeze property tax reimbursement - 800 882-6597. 250 Veteran Property Tax Deduction.

Here are the programs that can. Covid19njgov Call NJPIES Call Center for medical information related to COVID. 100 permanently and totally.

Veteran Senior Citizen Deductions. There are four main tax exemptions we will get into in detail. Aside from tax relief programs you may be eligible for property tax exemptions in NJ.

Active Military Service Property Tax Deferment. More than 57000 veterans will soon be eligible for help paying their property taxes after New Jersey voters on Tuesday appeared to overwhelmingly support a. Veteran property tax deduction Active.

Annual Deduction for Veterans. Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their surviving spousecivil uniondomestic partner who are residents of a continuing care. 9 days ago Is There A Nj Homestead Rebate For 2021.

Veterans must have active duty. NJ Division of Taxation - Local Property Tax 100 Disabled Veteran Property Tax Exemption Effective December 4 2020 State law PL. 100 Disabled Veteran Property Tax Exemption.

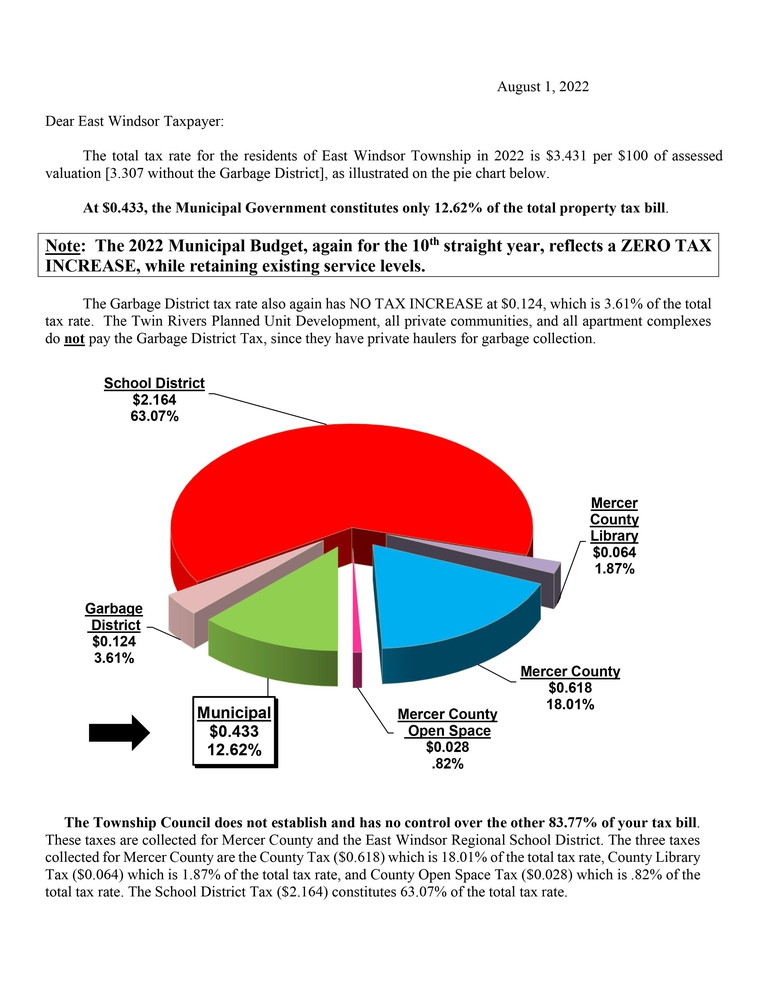

You file a Senior Freeze Property Tax Reimbursement application for the same year. The ballot question which passed with 76 of the vote makes. Your 2022 Municipal Property Tax bill will include a New Jersey Homestead Benefit for those who are renters whose primary.

Check if youre eligible today. The Ocean County Board of Taxation is one of the more advanced assessment systems in the State of New Jersey.

Tax Finance Dept Sparta Township New Jersey

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

State Of Nj Department Of The Treasury Division Of Taxation

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Division Of Veterans Services Cape May County Nj Official Website

State Tax Information For Military Members And Retirees Military Com

Nj Property Tax Relief Plan Could Give Homeowners 700 Rebates

Tax Breaks For N J Veterans And Who Qualifies Nj Com

New Jersey Military And Veterans Benefits The Official Army Benefits Website

Nj Voters Expand Property Tax Help For Veterans Here S How To Apply

Nj Division Of Taxation 2018 Income Tax Changes

Division Of Veterans Services Cape May County Nj Official Website

Nj Election Expand Tax Aid For Veterans What You Need To Know

Official Website Of East Windsor Township New Jersey Tax Collector

Gopal Bill To Expand Eligibility For Veterans Property Tax Deduction And Exemption Advances Nj Senate Democrats